Why Payment Gateway Security Matters

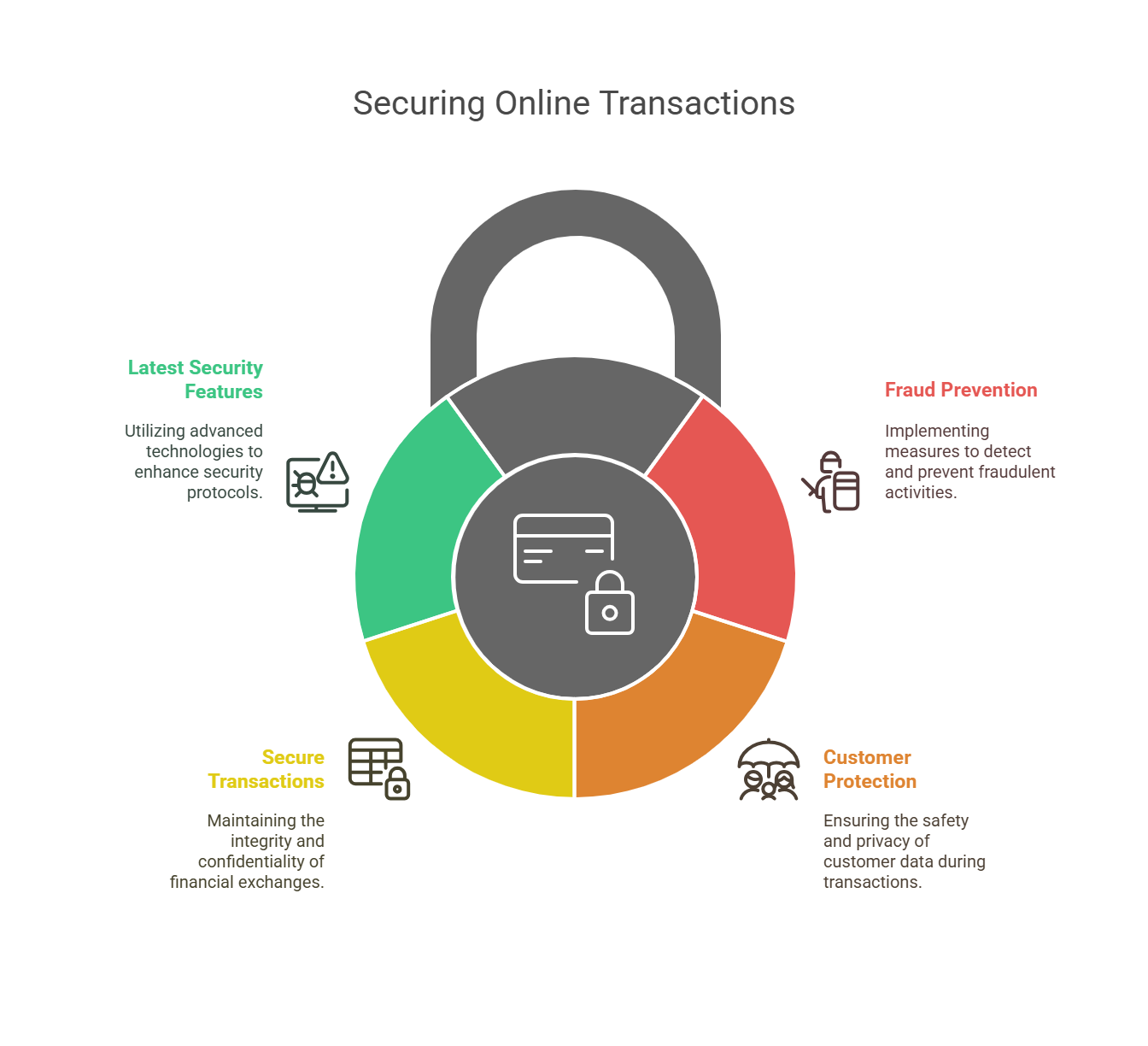

Online businesses face more risks from payment fraud today. Securing your payment gateway is essential to protect your business and your customers. Preventing fraud helps create a safe and smooth shopping experience.

A payment gateway connects customers to merchants and helps process secure transactions. As cybercrime grows, it’s more important than ever to make sure your payment security is strong.

In this guide, we’ll share easy-to-follow tips, the latest security features, and fraud prevention methods to help keep your eCommerce store safe.

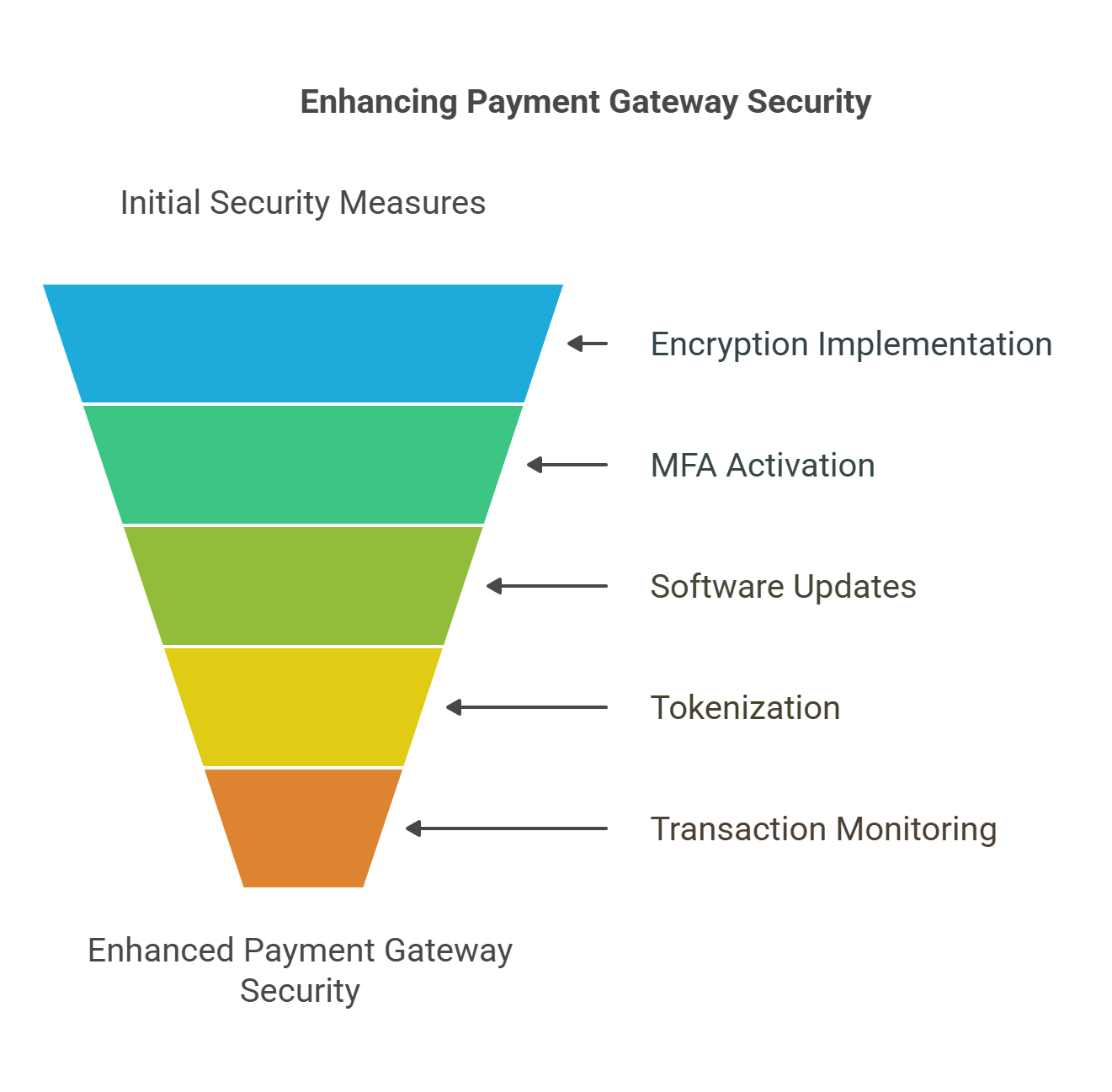

How to Improve Payment Gateway Security for eCommerce

Here are some simple ways to make your payment gateway safer:

Use Strong Encryption

Encryption protects your customers’ sensitive information. SSL certificates encrypt the data that passes between your customer’s browser and your server. This makes it hard for hackers to access payment details.

Enable Multi-Factor Authentication (MFA)

MFA adds extra security. Customers confirm their identity in two steps. For example, they enter a password and then verify a code sent to their phone. This makes it harder for hackers to break in.

Update Software Regularly

Old software can be a big risk. Make sure your payment gateway software is always up-to-date with the latest security updates and patches.

Tokenize Payment Data

Tokenization replaces sensitive information with a random string of characters called a token. Even if hackers get hold of the token, they won’t be able to use it.

Monitor and Analyze Transactions

Monitoring transactions in real-time helps catch suspicious activity quickly. For example, you can spot multiple purchases from the same IP address. Machine learning tools can also help identify fraud before it becomes a problem.

Best Practices for Secure Online Payment Processing

To keep payment processing safe, follow these best practices:

Choose a Secure Payment Gateway Provider

Pick a provider that’s PCI-DSS compliant. This ensures they meet high security standards for handling payment information.

Limit Data Storage

Only store the payment information you absolutely need. If you have to store data, make sure it’s encrypted and tokenized for extra protection.

Use Fraud Detection Tools

Fraud detection tools automatically flag suspicious activities, so you can catch problems early and take action quickly.

Use Secure Payment Forms

Ensure your payment forms are secure. Use HTTPS and send customers to a safe page for entering payment details.

Enable Two-Factor Authentication for Account Access

Make it harder for hackers to access accounts. Require customers to log in using two types of identification, such as a password and a fingerprint.

Latest Payment Gateway Security Features

The security features in payment gateways are always improving. Here are some of the latest tools to protect your eCommerce business:

| Feature | Description | Benefit |

|---|---|---|

| Tokenization | Replaces sensitive data with a random token | Protects data in case of a breach |

| 3D Secure 2 (3DS2) | Adds extra verification during checkout | Helps prevent fraud and chargebacks |

| Biometric Authentication | Uses fingerprints or facial recognition for login | Provides more security and convenience |

| AI-Powered Fraud Detection | Uses AI to detect and block suspicious patterns | Helps stop fraud in real-time |

| End-to-End Encryption (E2EE) | Secures payment data from start to finish | Ensures payment data stays private |

These features, combined with best practices, make a strong security system for your payment gateway.

How Does Tokenization Enhance Payment Gateway Security?

Tokenization is a technique that replaces sensitive payment data with a random string of characters, called a token. Even if hackers manage to access the token, they can’t use it.

Here’s how tokenization works:

-

A customer enters payment details, and the gateway sends the data to the processor.

-

The processor returns a token, which is stored instead of the sensitive data.

-

The token is used for future transactions, and the original data stays secure.

Tokenization reduces the risk of data breaches by making sensitive data useless to hackers.

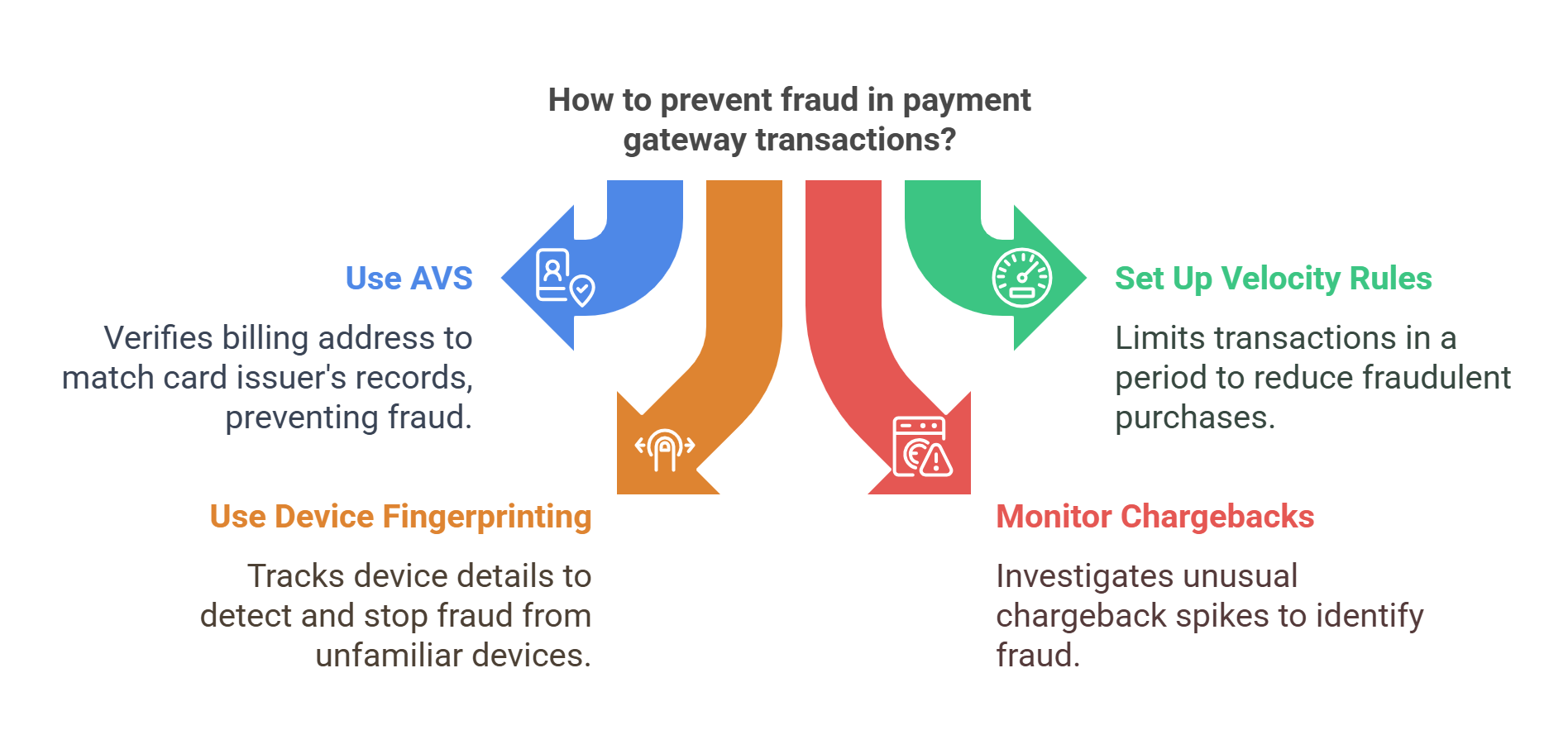

How to Prevent Fraud in Payment Gateway Transactions

Preventing fraud requires a few layers of security:

Use Address Verification Systems (AVS)

AVS checks if the billing address entered by the customer matches the one the card issuer has on file. If they don’t match, it could be a sign of fraud.

Set Up Velocity Rules

Velocity rules limit how many transactions can be made in a certain period. This helps reduce the risk of fraudulent purchases.

Use Device Fingerprinting

Device fingerprinting tracks the customer’s device details, like their IP address and browser. If fraud is detected from a new or unfamiliar device, you can stop the transaction.

Monitor Chargebacks

If you notice a lot of chargebacks, it could be a sign of fraud. Watch for sudden spikes and investigate any unusual activity.

Quick Answer Box: Payment Fraud Prevention Tips

-

Encrypt all transactions: Make sure sensitive data is encrypted to keep it safe.

-

Enable two-factor authentication: Add another layer of protection by verifying identity through two methods.

-

Use tokenization: Replace sensitive data with a token that can’t be used by hackers.

-

Monitor transactions regularly: Keep an eye on activity to spot any issues early.

-

Choose a secure payment provider: Select a provider that follows PCI-DSS security standards.

Research-Backed Payment Gateway Security Strategies

-

Forrester’s Study: AI-driven fraud detection cuts fraud by 30%.

-

University of Texas: Tokenization reduces data breaches by 50%.

-

PCI Security Standards: Recommends using encryption and tokenization to prevent unauthorized access.

-

McKinsey 2024 Report: Multi-factor authentication reduces account takeovers by 25%.

-

NIST Guidelines: Stress using SSL and TLS to protect payment data.

Expert Predictions: Payment Gateway Security in 2025

By 2025, payment gateway security will rely more on blockchain to prevent fraud. AI-powered fraud detection will become the norm, and biometric authentication will be more widely used, offering customers a smoother, more secure experience.

FAQs: Payment Gateway Security

Q: How can I improve payment security for my eCommerce store?

A: Use SSL certificates, tokenization, multi-factor authentication, and fraud detection tools.

Q: What’s the role of tokenization in payment security?

A: Tokenization replaces sensitive data with a token, which helps protect against data breaches.

Your Custom Payment Gateway Security Implementation Plan

-

Start with PCI Compliance: Ensure your provider is PCI-DSS compliant.

-

Enable Tokenization: Use tokenization to protect payment data.

-

Add MFA: Use multi-factor authentication for extra security.

-

Monitor Transactions: Set up alerts for suspicious transactions.

-

Use Fraud Prevention Tools: Invest in AI-powered fraud detection systems.

Final Thoughts: Don’t Compromise on Payment Gateway Security

Stopping fraud is an ongoing task, but by using the right tools and strategies, you can protect your business and customers. Invest in security now to keep your business safe in the future.